What It Really Costs to Build a House on Your Lot in Texas

Break down real‑world costs and hidden line items when building in Texas.

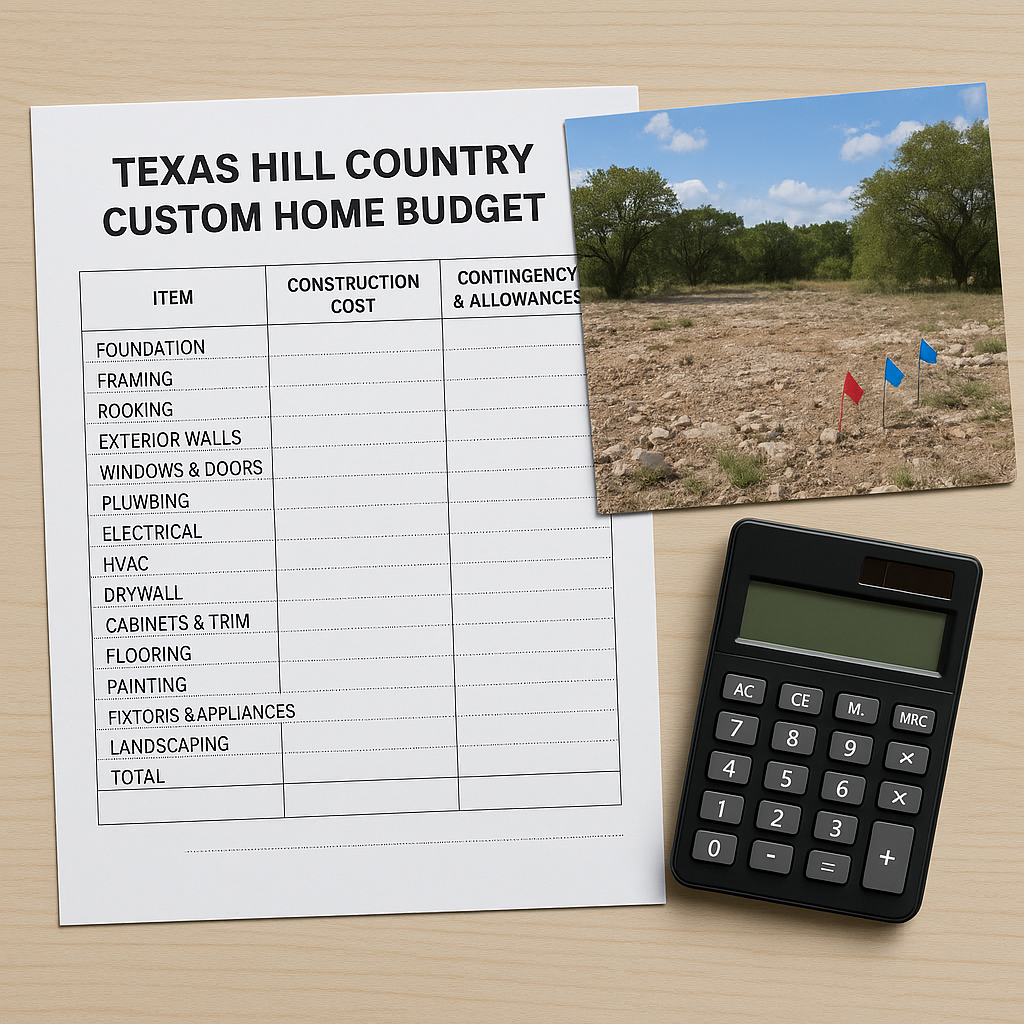

Big buckets: land, sitework, house, soft costs, and contingency

Online calculators like to boil custom homes down to a single “price per square foot,” but in Texas—especially on rural Hill Country lots—the real cost picture is more nuanced. To budget well, it helps to see the project as several big buckets you can estimate and control. 1) Land. If you already own your lot, this may be sunk cost, but it still affects lenders, appraisers, and your overall equity. Land prices vary wildly depending on acreage, views, trees, and proximity to Austin or San Antonio. 2) Sitework and infrastructure. This is where many budgets go sideways. Sitework on a Texas Hill Country lot can easily reach 20–30% of the total project cost and includes: - Clearing and rough grading. - Driveway and culverts (especially where you tie into a county or state road). - Rock excavation for the pad, utilities, and any retaining walls. - Septic system (or sewer tap and line if available). - Well drilling or water tap. - Power, internet, and propane trenching and hookups. A Texas‑focused budgeting guide from SRC Land walks through these components and the ranges they often fall into across the state: Budgeting: how much does it cost to build a house in Texas. 3) The house itself. This is the vertical construction—foundation, framing, roof, windows/doors, mechanical systems, insulation, drywall, finishes. For a custom Hill Country home, the cost per square foot for the house can vary widely based on design complexity and finishes, even before you add pools, detached garages, or outdoor kitchens. 4) Soft costs. These are often overlooked: surveys, soils reports, engineering, permitting, lender fees, title, and interim interest on a construction loan. NAHB’s consumer resources on buying and building explain how these soft costs typically fit into a new‑home budget: NAHB consumer home buying and building resources. 5) Contingency. Every serious Texas builder and lender will recommend a contingency fund—usually 10–15% of hard costs—to cover unknowns. Rock that’s harder than expected, a septic field that has to move, a transformer that needs relocation: these don’t show up in glossy allowances but they are real money. When you think in these buckets, you can have clearer conversations with builders and lenders and understand where you have flexibility (finishes, square footage) and where you don’t (rock, access, code requirements).

Hidden and variable costs that surprise many Texas landowners

Beyond the obvious line items, several costs consistently surprise first‑time Texas builders—particularly those used to city lots with flat dirt and existing utilities. Rock and earthwork. Hill Country limestone is beautiful above grade and stubborn below it. Budgets that assume “easy digging” can implode once utility or foundation trenches hit solid rock. Good contracts handle this with unit prices (per cubic yard or per hour of hammering) instead of wishful thinking. A practical article on budgeting rock and sitework from a Texas builder can give you a sense of how those unit prices work in the real world. Utilities and driveways. Long rural drives and shared utility trenches are expensive. Power providers like Pedernales Electric Cooperative spell out what they will and won’t cover and how far they’ll go; reviewing their new‑service steps early helps you understand what belongs in your budget: PEC new residential service steps. Don’t forget conduit for future internet and low‑voltage runs—digging one more trench through limestone later is far more expensive than adding a spare pipe today. Permits, fees, and inspections. In city limits and many ETJs, you’ll pay plan review, building, and inspection fees. Rural areas often trade those for septic permits and driveway approvals. Texas’ on‑site sewage facility rules, summarized here by the TCEQ, affect both design and cost: TCEQ OSSF design guide (PDF). If your project disturbs more than an acre, you may also need basic stormwater controls; the TCEQ’s construction stormwater overview explains when that applies: TCEQ construction stormwater permit overview. Financing friction. Construction loans are different from regular mortgages. You’ll pay closing costs, interest‑only payments during construction, and sometimes extra inspection fees tied to draws. The Consumer Financial Protection Bureau lays out how construction loans work, how draws are handled, and what you’ll likely owe along the way: CFPB construction loan explainer. Insurance and risk. Builder’s risk insurance (often required by lenders) is separate from your eventual homeowner’s policy and typically covers the structure while it’s under construction. The Texas Department of Insurance offers a clear overview of what builder’s risk does and doesn’t cover: Texas Department of Insurance: builder’s risk insurance overview. Finally, allowances and upgrades. Many “sticker prices” assume allowances for appliances, lighting, flooring, and tile that don’t match what owners actually choose. If a bid’s allowances look thin compared to your taste, your real cost will be higher than the headline number. It’s better to adjust allowances up now than to be surprised later.

How to build a realistic budget and keep it on track during build

Once you understand the major and hidden costs, you can build a realistic budget—and manage it through construction—without constant anxiety. Start by aligning design with budget. Before going deep into custom plans, share your all‑in budget (including land and sitework) with your builder and, if applicable, architect. Ask them to back into a target house budget from that number. Then design to that, instead of designing first and hoping it prices in range. National guidance from NAHB on determining your budget, including how lenders look at your finances and project, is a helpful reference: NAHB: determine your home budget. Build your spreadsheet with separate sections for: - Land and closing. - Surveys, soils, engineering, and permits. - Sitework (broken out by driveway, rock, utilities, septic/well, retaining). - House construction by CSI division (foundation, framing, roofing, windows/doors, mechanicals, finishes). - Soft costs (lender fees, title, insurance, interim interest). - Contingency. Then, pressure‑test it with your lender and builder. Ask where they commonly see overruns on lots like yours and adjust those lines before you sign. During construction, treat the budget as a living tool: - Track actuals vs. budget at each draw. - Approve written change orders that clearly show added cost and schedule impact. - Protect contingency for true unknowns (subsurface rock, utility moves), not purely cosmetic upgrades. On the financing side, consider construction‑to‑permanent loans that roll into a mortgage at completion; they typically mean one set of closing costs and less interest‑rate risk. Regional banks and credit unions that regularly make these loans to Texas custom builders can walk you through one‑time‑close vs. two‑time‑close options; Texas Regional Bank’s overview of construction‑loan requirements is a good example of what lenders will expect to see in your plans and budget: Texas Regional Bank: ready to build your home construction loan guide. Finally, remember that you control the biggest cost drivers: square footage, complexity, and finish level. A slightly smaller, simpler home with durable, well‑chosen materials almost always feels better—and costs less over time—than a maxed‑out plan that squeezes your budget at every stage. With clear eyes about what it really costs to build in Texas, you can make trade‑offs intentionally, not under duress, and end up with a home and payment that fit your life for the long haul.

.png?width=400&height=133&name=TRUE%20STONE%20LOGO%20(1).png)